January 10, 2024

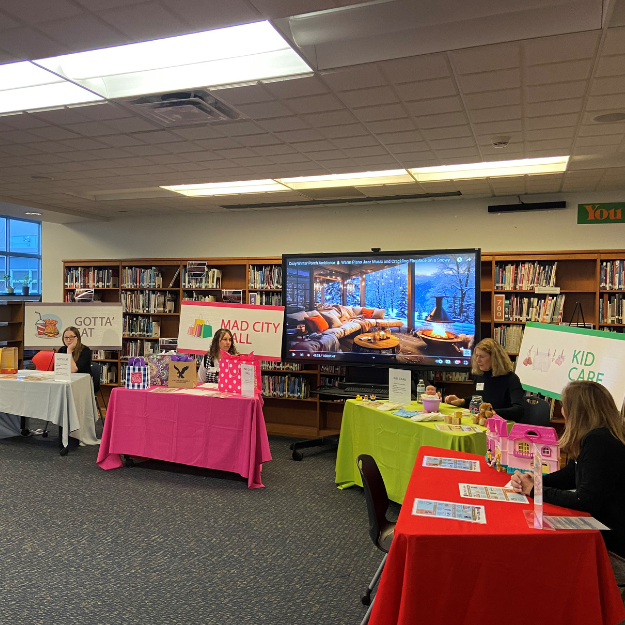

High Point FCU Brings Mad City Money to Salamanca Seniors

High Point Federal Credit Union staff shared their Mad City Money program with Salamanca High School with almost 90 seniors participating in this program. The Credit Union (CU) first implemented […]

Read More